Running a law firm isn’t an easy task, especially during a global pandemic that has spurred on an economic recession. As such, cash flow management is more important than ever where your accounts may be practicing social distancing too. During a crisis such as COVID-19, finding law firm billing systems that work for your firm as well as your clients is crucial. Moreover, according to researchers, cloud-based accounting tools are the biggest time-saver for law firms, allowing them to focus on what is important, work more effectively, and keeping a better track of business cash flow.

Managing these accounts under normal circumstances can be challenging enough. With your day-to-day tasks of running a law practice, managing the cash flow can take a toll on you and your staff. The key here is to accept that although times may be tough, there are a number of tools to assist you in adapting to the current economic climate. In this blog post, we will go over which steps you can take to improve your firm’s cash flow, and how Amberlo’s billing system can save you time and money.

6 Ways to Boost Your Law Firm’s Cash Flow

Having the chance to improve your firm’s income stream should never be turned away, pandemic or not.

Not knowing how to manage your money can be a threat to your firm and your staff. Here are 6 strategies to assist with your law firm accounting.

Step One: Evaluate Current Cash Flow

Before looking at ways to enhance your firm’s accounts, it’s best to get a thorough understanding of your current situation. Understanding where you are and where you need to be is essential to mapping out an effective strategy. By doing so, you can pinpoint where your slow periods are, which clients are behind on payments, and how you can improve your transaction methods.

Step Two: Set Financial Goals

Setting financial goals will provide a benchmark for future forecasts and evaluations. It will make sure that your firm stays on budget and that key targets are being met. It also stops you from straying away from your financial plan and spending money unnecessarily.

Step Three: Offer Payment Plans

One way to ensure a steady flow of cash is to meet your clients’ needs. The more painless it is for them to make payments, the easier it will be to keep your accounts in positive figures.

There are a number of payment methods and plans to offer your clients:

- Evergreen retainers

- Hourly fees

- Contingency fees

- Fixed flat rates

It’s highly recommended to find a payment plan that suits your clients, your service offering, and your financial statements. Having the right mix of payments can ensure a steady flow of income while maintaining a winning customer service.

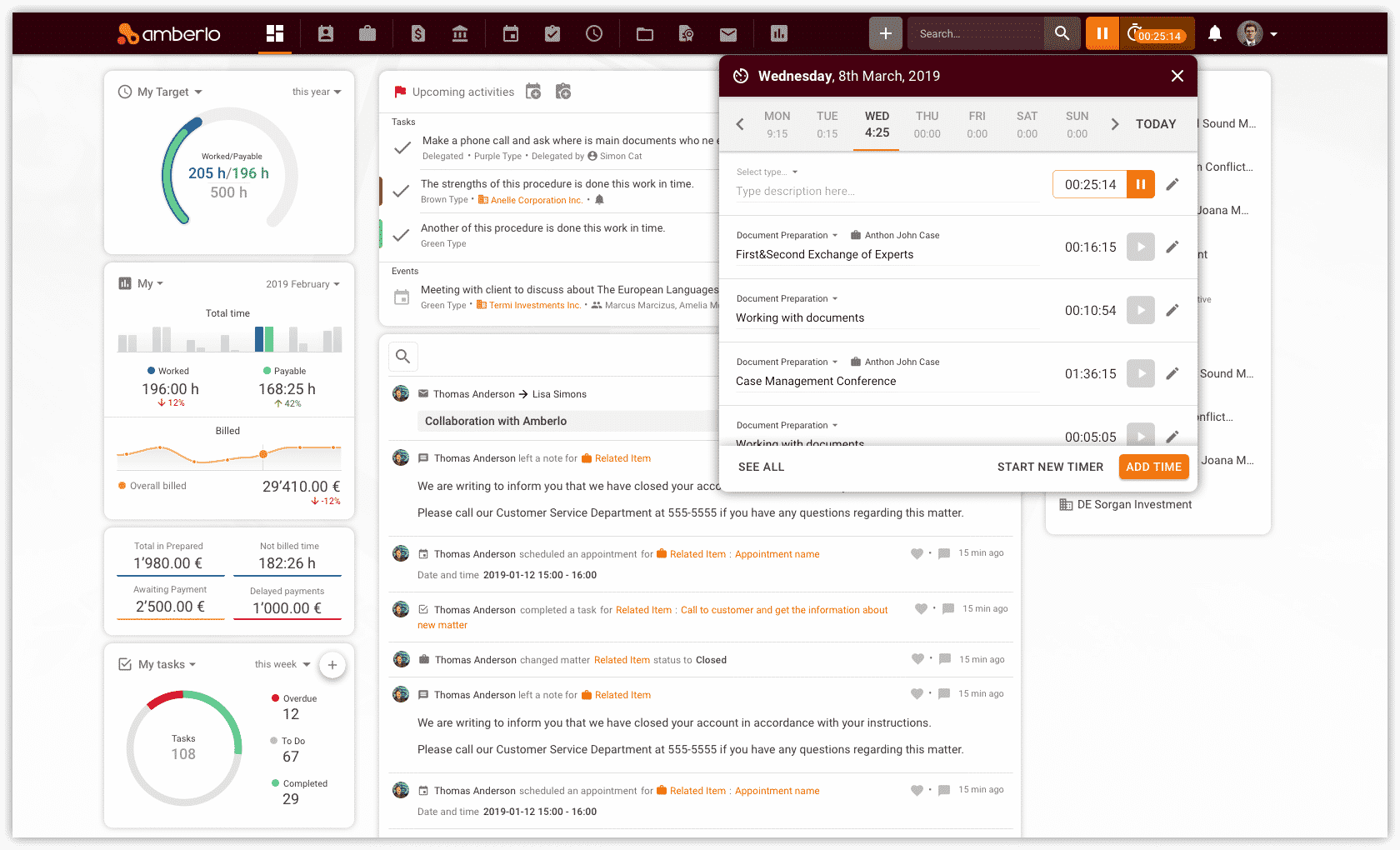

Step Four: Optimize Account Recording

One of the best ways to manage your law firm accounting is by having a clear accounts receivable management process. Law firm billing is a tedious process that is extremely admin heavy. What work hasn’t been billed? What has been billed but not paid? The mix of invoices, reminders, and overdue accounts can be a handful to manage on top of your day-to-day law duties. All of this can be seen from the main screen of Amberlo giving you a 360-degree view of your firm’s financial health. Moreover, it will make this process easier and a lot faster, because tools like Amberlo gives you back your time by sending automated reminders via email when a bill is past-due.

Step Five: Improve Productivity with the Right Technology

Assisting with client payments isn’t the only way to boost a firm’s cash flow. In fact, you can save a huge chunk of your budget through productivity management. The amount of time spent on remedial tasks can easily be reduced through the use of technology and automated processes.

When the client matters, contact management, documentation, time and expense tracking are done for you, this opens up the amount of time you can spend on tasks that bring you money. It will also reduce the number of man-hours needed therefore decreasing your overall budget spend.

Step Six: Increase Forecast Frequency

Financial forecasting is often done on an annual basis. However, if you’re wanting a more accurate snapshot of where your business is and where it’s going, it’s best to do this quarterly. By doing so, you will be better prepared in terms of meeting your financial goals and crafting effective strategies as a result.

How Amberlo Can Help Your Law Firm Accounting

Not only is Amberlo a leading law firm case management system, but is also optimized to assist lawyers with their law firm billing and accounting. From expense tracking to final invoicing, let Amberlo handle it for you while you focus on building a successful business. For more about our law firm accounting services, please get in touch with us.